Exploring the Pros and Cons of Investing in an ICO

Initial Coin Offerings (ICOs) have emerged as a popular method for fundraising in the cryptocurrency world. They offer investors the opportunity to participate in exciting projects and potentially reap substantial returns. However, like any investment, there are pros and cons to consider. In this blog, we will delve into the advantages and drawbacks of investing in an ICO, providing you with valuable insights to make informed investment decisions.

Pros of Investing in an ICO:

Early Access to Promising Projects:

One of the key advantages of investing in an ICO is the opportunity to gain early access to innovative blockchain projects. By investing in an ICO, you can support cutting-edge ideas and technologies that have the potential to disrupt industries and revolutionize various sectors.

Potential for High Returns:

Investing in successful ICOs can yield significant returns. Many early investors in well-known cryptocurrencies, such as Ethereum and Ripple, witnessed substantial gains. If you can identify a promising project with a strong team, solid concept, and robust execution plan, there is a chance to generate impressive profits.

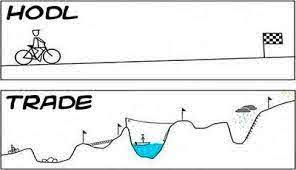

Liquidity and Market Opportunities:

ICOs provide liquidity to investors by allowing them to buy and sell tokens on cryptocurrency exchanges. With a well-established market, investors can take advantage of trading opportunities, capitalizing on price fluctuations to enhance their investment positions.

Diversification:

Participating in ICOs enables investors to diversify their cryptocurrency portfolios. By allocating funds across different projects and industries, investors can reduce their exposure to specific risks, thereby spreading their investments across a range of promising ventures.

Cons of Investing in an ICO:

High Risk:

Investing in ICOs carries a significant level of risk. The cryptocurrency market is highly volatile, and many ICO projects fail to deliver on their promises. It’s crucial to conduct thorough research and due diligence to identify legitimate projects and avoid scams or poorly executed ventures.

Lack of Regulation:

ICOs are largely unregulated, which can make investors susceptible to fraud, misleading information, and unethical practices. The absence of clear guidelines and oversight means investors must be cautious and exercise caution when assessing potential projects.

Uncertain Market Valuations:

Determining the true value of an ICO project can be challenging. Many projects lack a proven track record or a functional product at the time of their ICO. Valuations are often based on speculation and market sentiment, which can lead to price volatility and potential overvaluation.

Limited Investor Protection:

Investing in an ICO does not offer the same level of investor protection as traditional investment avenues. In case of fraudulent activities or project failure, recovering invested funds can be challenging, if not impossible. Investors must be aware of the risks and be prepared to accept the potential loss of their investment.

Conclusion:

Investing in an ICO can be an enticing opportunity for those seeking to participate in groundbreaking projects and potentially secure high returns. However, it is crucial to approach ICOs with caution, conducting thorough research and analysis. While the potential for significant profits exists, it is equally important to acknowledge the inherent risks and challenges associated with this investment avenue. By understanding both the pros and cons, investors can make informed decisions and navigate the dynamic landscape of ICO investing more effectively.