How Will Crypto Markets Move When $4.2B Bitcoin Options Expire Today?

Around 62,600 Bitcoin options contracts are expiring on Friday, Oct. 25, with a notional value of around $4.26 billion.

Today’s options expiry is a month-end event, which makes it much larger than regular weekly expiries. Moreover, spot markets have been in decline since their high on Monday, so can the trend be reversed?

Bitcoin Options Expiry

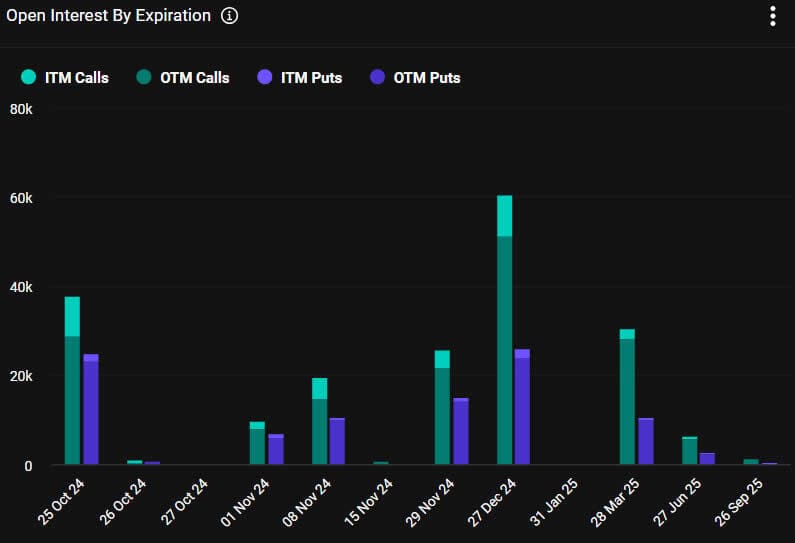

This week’s big batch of Bitcoin options contracts has a put/call ratio of 0.66, meaning that there are significantly more long (call) contracts expiring than shorts (puts).

Additionally, open interest (OI), or the value or number of open options contracts yet to expire, remains high at the strike price of $70,000, with over a billion dollars, according to Deribit.

There is also a whopping $1.2 billion in OI at the $80,000 strike price, suggesting the derivatives bulls are getting confident that market momentum will continue.

Additionally, Bitcoin futures OI reached record highs earlier this week, topping $40 billion, according to Coinglass. However, some of this leverage was flushed in this week’s market pullback.

Crypto derivatives provider Greeks Live commented that the dominance of BTC in the options market is now back to 2021 levels. It added that this was “directly related to the weakness of ETH, and options market indicators are now almost exclusively based on BTC data.”

In its weekly crypto derivatives report, Deribit noted that the upcoming US presidential election is still greatly impacting market dynamics.

“Implied volatility for 14-day tenor options in both ETH and BTC is rising, now approaching levels seen in longer-tenor options.”

“Tenor options” allow the contract buyer to choose the maturity date that best suits their needs and can be tailored to manage risks.

In addition to today’s Bitcoin options, there are 403,000 Ethereum options that are about to expire with a put/call ratio of 0.97 and a notional value of $1 billion. This brings Friday’s crypto options expiry to around $5.3 billion for the week.

Crypto Market Outlook

Crypto markets are ending a week of declines with a slight recovery as total capitalization reached $2.42 trillion during early trading in Asia on Friday morning.

Bitcoin has recovered almost all of its losses, tapping an intraday high of $68,821 late on Thursday before pulling back to below $68,000. The asset remains up 13% over the past fortnight.

The same cannot be said for Ethereum, which is still in the doldrums, trading down slightly on the day and hovering around the $2,500 level.

The post How Will Crypto Markets Move When $4.2B Bitcoin Options Expire Today? appeared first on CryptoPotato.

Powered by WPeMatico