BTC Price Came 3% Away From Charting New ATH as Bitcoin ETF Inflow Streak Equals Record

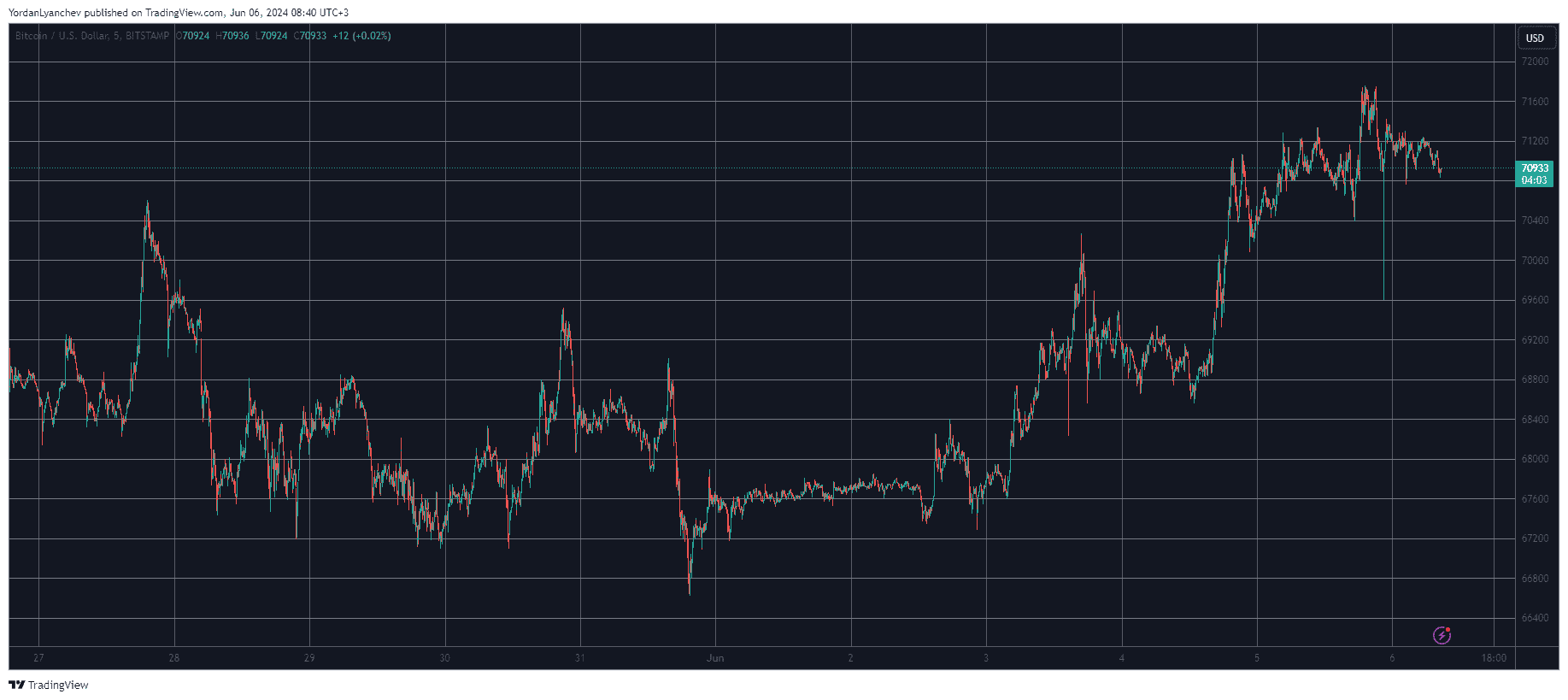

After a relatively quiet and sluggish weekend, bitcoin’s price started moving north once again at the start of the business week and kept rising until it popped to $71,767 (on Bitstamp) yesterday evening.

This came amid the growing inflows toward most US-based spot Bitcoin ETFs, as yesterday saw nearly $500 million being poured in. Even Grayscale’s GBTC saw positive flows.

What’s even more impressive about the amount of USD going into the largest US spot BTC ETFs is the streak they have been on.

The last time there were outflows from these financial vehicles was nearly a month ago – on May 10. Since then, there have been very few occasional outflows from certain ETFs, like $100 million being taken out of Ark Invest’s ARKB on May 30, but the overall numbers have not been in the red.

Thus, the positive streak of consecutive inflow days has risen to 16, which equals the previous record set in February. As reported recently, June 4 saw the second-biggest day of inflows ($886.6 million), while the number for yesterday was $488.1 million.

Fidelity’s FBTC was once again in the lead, raking in more than $220 million. BlackRock’s IBIT followed suit with $155.4 million, and even Grayscale’s GBTC, which has seen the most substantial outflows ever since its conversion, gathered $14.6 million.

These positive numbers were perhaps the main source fueling another price rally for the underlying asset. BTC had dipped to around $69,000 on June 4 but started gaining traction once again yesterday and soared to a 15-day peak of $71,767 (Bitstamp).

As such, bitcoin came less than 3% away from its all-time high set on March 14 ($73,737). Despite losing around a grand since then, the crypto community believes charting a fresh peak is a matter of when and not if.

The post BTC Price Came 3% Away From Charting New ATH as Bitcoin ETF Inflow Streak Equals Record appeared first on CryptoPotato.

Powered by WPeMatico