Can The Big $5 Billion Crypto Options Expiry Event Today Shift Market Momentum?

Around 62,000 Bitcoin options contracts are due for expiry on Friday, August 30. They have a notional value of around $3.65 billion.

Today’s options expiry event is a large one due to it being the end of the month. However, spot markets are rarely rattled by these derivatives developments which serve more as an indication of market sentiment.

Bitcoin Options Expiry

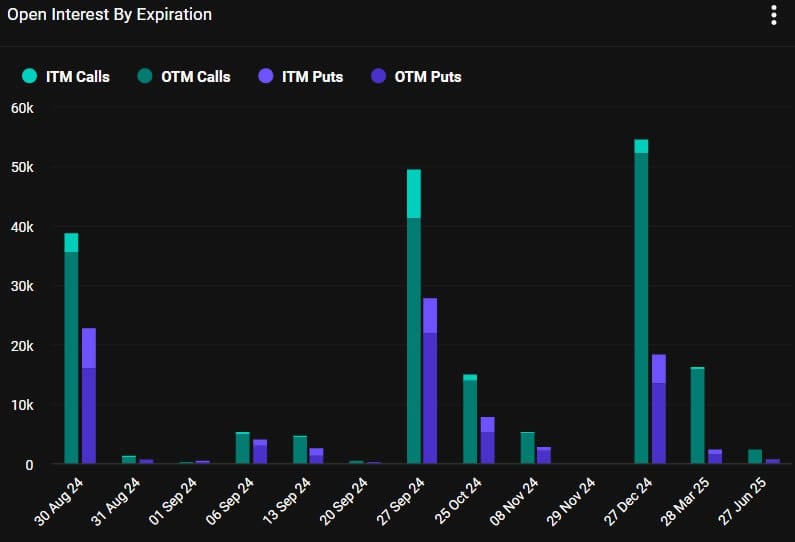

This week’s big batch of Bitcoin options contracts has a put/call ratio of 0.59, which means there are almost twice as many long (call) contracts expiring than shorts (puts).

Open interest, or the number of value of contracts yet to expire, is still high at strike prices of $70,000 and $75,000, according to Deribit.

Additionally, there is around $793 million in OI at the $90,000 strike price and still $987 million at the $100,000 strike price.

Crypto derivatives provider Greeks Live commented that the markets have fallen in line with Nvidia stock despite the firm beating Wall Street expectations in its earnings report this week.

In addition to today’s expiring Bitcoin options, there are $1.35 billion in notional value Ethereum contracts expiring. The 536,000 contracts have a put/call ratio of 0.50 which means there are exactly twice as many long contracts than shorts. OI is highest at the $4,000 strike price which has $373 million in open contracts.

Greeks Live also acknowledged all of the Ethereum FUD that has infected the market.

“All Fud ETH lately, and it’s true that ETH has been weak for a long time, and practical applications have been lackluster. But the market seems to be too pessimistic, and the options market has seen a number of Block options plunge in the last two days.”

Crypto Market Outlook

Crypto markets have declined this week, with total capitalization dropping around $200 billion. At the time of writing, the digital asset market was worth $2.17 trillion following a 1.5% decline on the day.

Bitcoin hit an intraday high of $61,000 but was sharply rejected at resistance there, falling back to $59,000 during the Friday morning Asian trading session.

Ethereum prices closed in on $2,600 but also couldn’t break resistance, falling back to $2,525 at the time of writing.

The altcoins were mixed but mostly flat on the day following a week or retreat.

The post Can The Big $5 Billion Crypto Options Expiry Event Today Shift Market Momentum? appeared first on CryptoPotato.

Powered by WPeMatico