Here’s How Many Traders Were Wrecked as Bitcoin (BTC) Exploded to $72K Amid Rising ETF Inflows

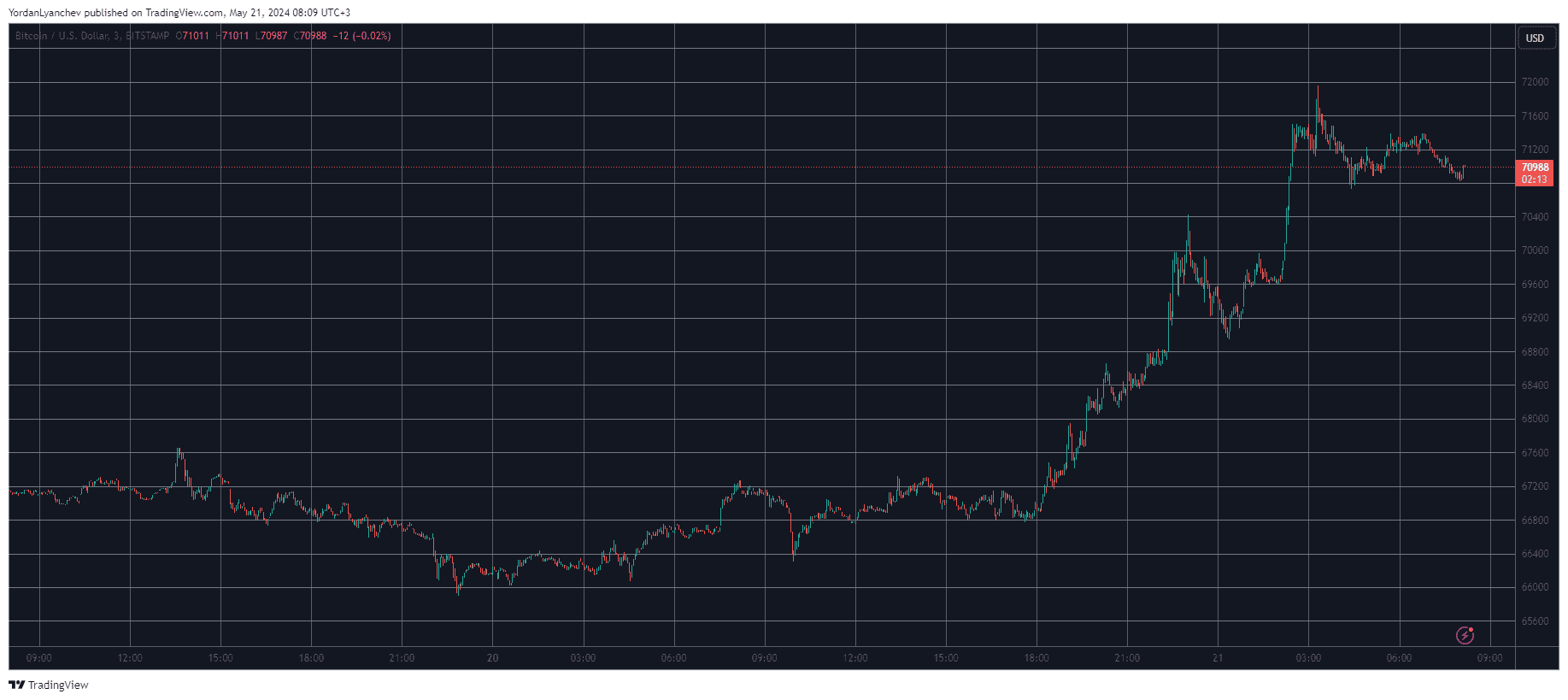

Bitcoin had a relatively quiet past few days, especially during the weekend, and had stalled at around $67,000 before the bulls initiated a mind-blowing leg up that drove the asset to less than $2,000 away from its ATH of $73,750.

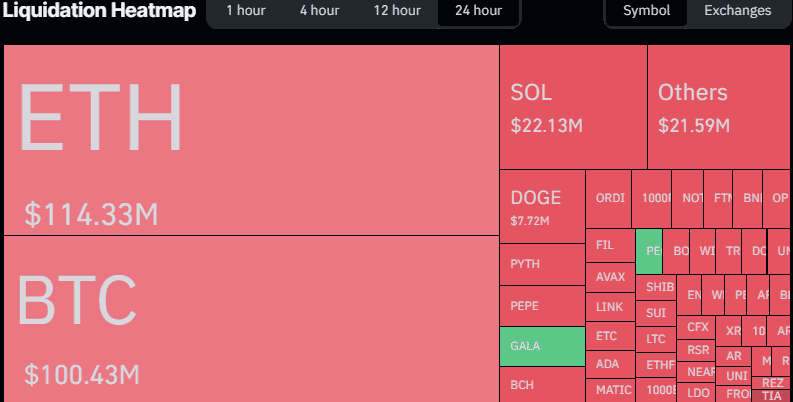

The alternative coins, led by ETH’s rally, are also in the run, and this volatility caused more than $300 million in losses for over-leveraged traders.

The primary cryptocurrency had regained lots of ground in the past week, surging from around $61,000 to $67,000. However, it failed to overcome the latter despite a few consecutive attempts.

That finally happened yesterday evening as the asset flew by the $67,500 resistance and neared $70,000. After a brief retracement from that level, the bulls broke it as well and pushed bitcoin to its highest price position since early April of $72,000.

Despite retracing by around a grand since then, BTC is still 5.5% up on the day. Perhaps one of the reasons behind these latest increases is the ETF inflows, which have reached a six-day streak. Data from FarSide shows that nearly $240 million entered those products on Monday.

However, BTC’s gains are nowhere near those of ETH. The second-largest cryptocurrency skyrocketed from under $3,000 to a multi-month high of its own of over $3,700 amid reemerged hopes of the US SEC approving Ethereum ETFs as early as this week.

At one point, the underlying asset gained over 20%, as analysts started speculating whether it would be able to top $4,000 if those financial products were indeed greenlighted.

The total crypto market cap added roughly $200 billion in a day. Such volatility typically results in lots of pain for over-leveraged traders, and nearly 80,000 of them have been liquidated in the past 24 hours.

The total value of wrecked positions sits at $340 million. Expectedly, ETH is responsible for the biggest piece of the pie, and the largest single liquidated position also belongs to it, which is valued at over $3 million.

The post Here’s How Many Traders Were Wrecked as Bitcoin (BTC) Exploded to $72K Amid Rising ETF Inflows appeared first on CryptoPotato.

Powered by WPeMatico