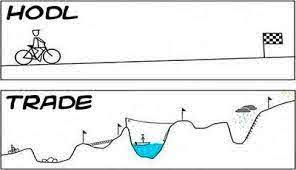

HODL vs. Pulling Profits: The Crypto Investor’s Dilemma Unraveled

n the fast-paced world of cryptocurrencies, investors often find themselves grappling with a crucial decision: HODL or pull profits? As the value of digital assets fluctuates wildly, emotions and uncertainty can cloud one’s judgment. In this blog, we’ll explore the age-old question, uncover its nuances, and provide insights to help you make well-informed decisions. So, fasten your seatbelts as we embark on this thrilling crypto journey!

HODL – The Battle Cry of Crypto Holders

HODL, a term derived from a misspelling of “HOLD,” has become a symbol of unwavering faith among crypto enthusiasts. To HODL means to hold on to your digital assets even during turbulent times, resisting the urge to sell when the market is in turmoil. The ethos of HODLing lies in the belief that cryptocurrencies will continue to rise in value over the long term. But, why HODL?

- Time is Your Ally: HODLers believe that cryptocurrencies, especially those with solid fundamentals, will eventually rebound and thrive over time. As technology and adoption progress, the value of crypto assets may appreciate significantly.

- Emotional Resilience: Volatility is a defining trait of the crypto market. By adopting a HODL mindset, you can avoid being swayed by short-term price fluctuations, allowing you to make rational decisions.

- Tax Efficiency: In some jurisdictions, holding on to your crypto for more than a year can lead to tax advantages. Long-term capital gains tax rates are typically lower than short-term rates, incentivizing HODLing.

Pulling Profits – The Temptation to Secure Gains

On the other side of the spectrum, we have the pull profits strategy. This approach involves selling a portion of your cryptocurrency holdings when you believe the price has reached a favorable level. Pulling profits allows you to crystallize gains and secure a return on your investment. But why do investors opt for this path?

- Capital Preservation: Cryptocurrencies can be highly unpredictable, and markets can experience sudden downturns. By pulling profits, investors can protect their initial capital and ensure they don’t suffer significant losses.

- Financial Goals: Many crypto investors have specific financial objectives, such as purchasing a new home, funding education, or other ventures. Pulling profits enables you to meet these goals without compromising your long-term holdings.

- Reducing Risk: By diversifying your investments and pulling profits when the opportunity arises, you spread your risk across various assets, reducing exposure to a single cryptocurrency’s price movements.

Finding the Right Balance – An Art and a Science

The decision to HODL or pull profits is highly subjective and depends on individual circumstances, risk tolerance, and financial goals. Both strategies have their merits, and finding the right balance between them is key to successful crypto investing. Here are some tips to help you navigate this decision-making process:

- Educate Yourself: Understanding the fundamentals of cryptocurrencies and the market dynamics is crucial. Stay informed through reputable sources to make well-informed decisions.

- Define Your Goals: Clarify your short-term and long-term financial objectives. Are you in it for the long haul, or do you have specific milestones you want to achieve?

- Set Realistic Targets: Be realistic about profit-taking. Aiming for astronomical gains might lead to missed opportunities, while overly conservative targets may leave potential profits on the table.

- Manage Emotions: Emotions can cloud judgment and lead to impulsive decisions. Establish a solid trading plan and stick to it, regardless of market fluctuations.

- Diversify Your Portfolio: Spreading your investments across different cryptocurrencies and other asset classes can help mitigate risk.

Conclusion

HODL or pull profits – the crypto investor’s dilemma boils down to striking a balance between your long-term beliefs and short-term financial needs. Understanding your risk appetite, financial goals, and market dynamics will guide you in making the best decisions for your cryptocurrency portfolio.

Remember, crypto investing is not a one-size-fits-all game. Stay true to your principles, remain resilient in the face of volatility, and continuously learn from your experiences. Whether you HODL or pull profits, the key is to enjoy the journey and embrace the thrilling world of cryptocurrencies with a clear vision. Happy investing!

Crypto Tuna