How Will Crypto Markets React to Massive $4.7B Bitcoin Options Expiry Today?

Crypto markets have declined slightly this week as sentiment wanes in the wake of last week’s US Securities and Exchange Commission’s approval of spot Ethereum exchange-traded funds.

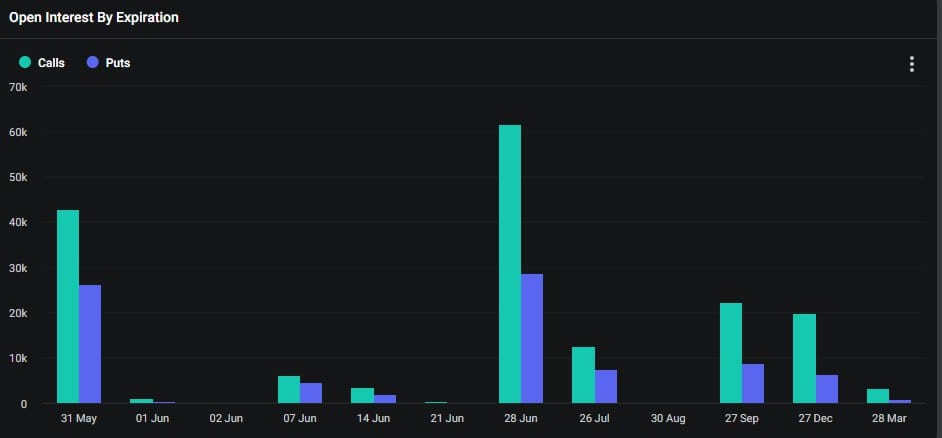

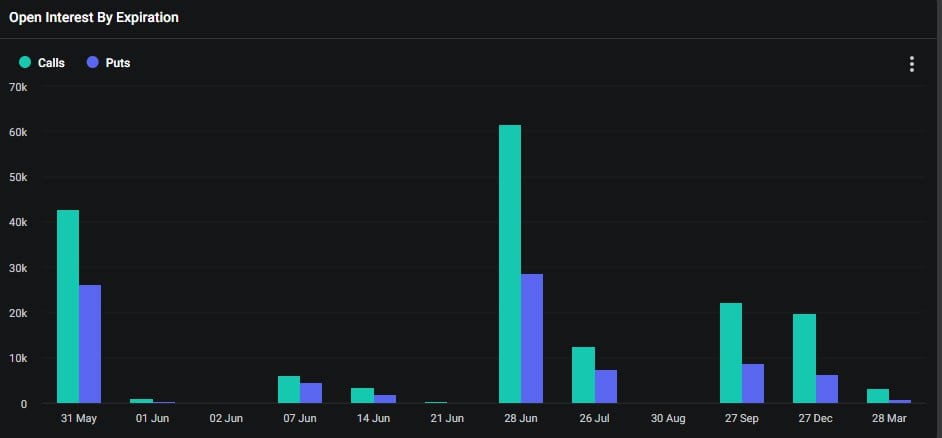

Nevertheless, volatility could increase when a whopping $4.7 billion in notional value Bitcoin options contracts expire on May 31.

The 69,200 contract expiry is huge compared to last week’s event, as month-end derivatives activities usually are, according to Deribit.

Bitcoin Options Expiry

The put/call ratio for this tranche of Bitcoin options is 0.61. This means that there are more calls (or long contracts) expiring than puts (or shorts). The point at which most losses will be made, called the max pain point, is around $65,000 which is $3,500 lower than current spot prices.

There is lots of open interest, or contracts that have yet to expire, at long positions, including strike prices at $70,000, $75,000, $80,000, and even $100,000, where OI is $886 million.

On the short side, the $60,000 strike price has the most OI at $519 million. This suggests that derivatives traders remain bullish on Bitcoin and expect higher prices.

The total OI notional value for all outstanding BTC options contracts is a whopping $19 billion.

In addition to today’s big batch of Bitcoin options, there are around $3.7 billion in notional value Ethereum contracts expiring. The 910,000 contracts have a put/call ratio of 0.84 with long and short sellers more evenly matched than for BTC contracts.

Additionally, Ethereum futures aggregated open interest has been hovering near all-time high levels this week at around $17 billion, driven by speculation around the spot ETF decision.

Crypto Martket Outlook

Spot markets rarely react to options expiry events, but today’s one is a biggie. Total capitalization has remained relatively flat on the day at $2.68 trillion. In fact, crypto markets have moved very little over the past 12 days or so.

Bitcoin inched up 1.2% on the day to trade at $68,489 at the time of writing, whereas Ethereum was falling back slightly at $3,751.

The altcoins were mostly still in the red, adding to their declines over the past few days, and meme coins were taking a particularly larger beating.

The post How Will Crypto Markets React to Massive $4.7B Bitcoin Options Expiry Today? appeared first on CryptoPotato.

Powered by WPeMatico