Inflation Tango: Bitcoin’s Bullish Dance with US CPI Data

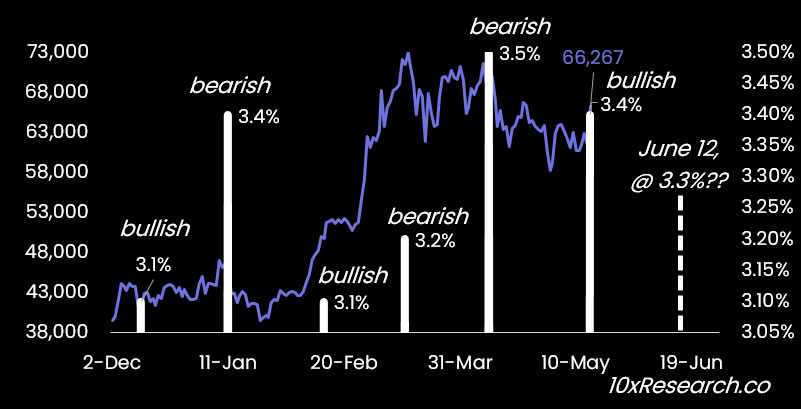

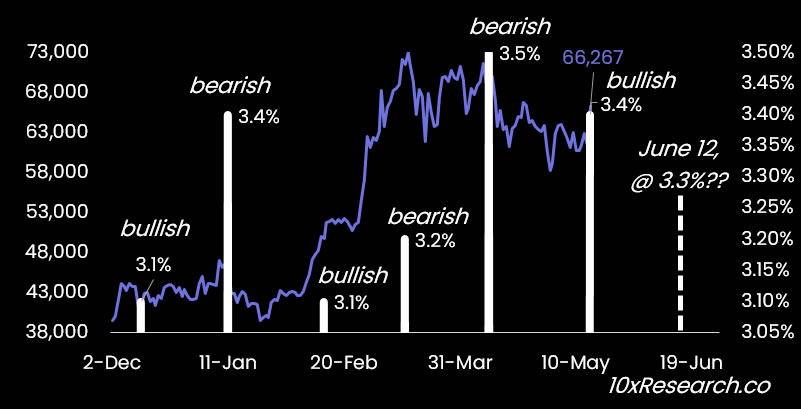

Bitcoin’s price has been sensitive to changes in inflation data – Consumer Price Index (CPI) – relative to the previous month, according to a May 29 market report from 10x Research analyst Markus Thielen.

He said that higher-than-expected CPI has been bearish for the cryptocurrency, while lower-than-expected CPI has been bullish.

Correlations With CPI Data

Additionally, spot Bitcoin ETF inflows closely followed CPI data releases, as they resumed or accelerated when CPI data showed lower inflation compared to the previous month.

The analysis plotted BTC price over the past six months against U.S. inflation data released, noting that when CPI was higher, the asset was bearish, and when the figure was lower than expected, it was bullish.

“Traders who know how Bitcoin reacts to CPI should have confidence in trading in the opposite direction of the CPI change relative to the previous month.”

The research predicts that Bitcoin ETF inflows will likely remain strong over the next two weeks leading up to the June 12 CPI data release, potentially pushing BTC to new all-time highs.

The pricing model projected a small decline when consensus expected another higher disappointing inflation print for May 15. Looking forward to the next two months, it predicts that inflation may hover around a similar level, “with a downward bias soon occurring.”

“If inflation prints 3.3% or lower, bitcoin should make a new all-time high.”

The analysis suggests that inflation is no longer a concern and will likely turn into a tailwind for Bitcoin as the summer progresses. U.S. inflation based on CPI data was 3.4% for April.

Additionally, core personal consumption expenditures (PCE) price index data, which is also the Federal Reserve’s preferred measure of inflation, is due on Friday, May 31.

BTC Price Outlook

Bitcoin is currently trading down 1% on the day at around $68,000. It dropped to an intraday low of $67,122 but managed to recover during the Thursday morning Asian trading session.

BTC has been relatively flat for the past fortnight and is down 7.7% from its mid-March all-time high as the consolidation continues.

The majority of the altcoins are seeing larger losses today, with markets retreating 1.3% to $2.68 total capitalization.

The post Inflation Tango: Bitcoin’s Bullish Dance with US CPI Data appeared first on CryptoPotato.

Powered by WPeMatico