US Treasury Predicts Stablecoin Market Could Surge to $2 Trillion by 2028

With the growth of the cryptocurrency and digital asset economy has come the expansion of the stablecoin market in the United States and abroad, stated the US Treasury in a report released on April 30.

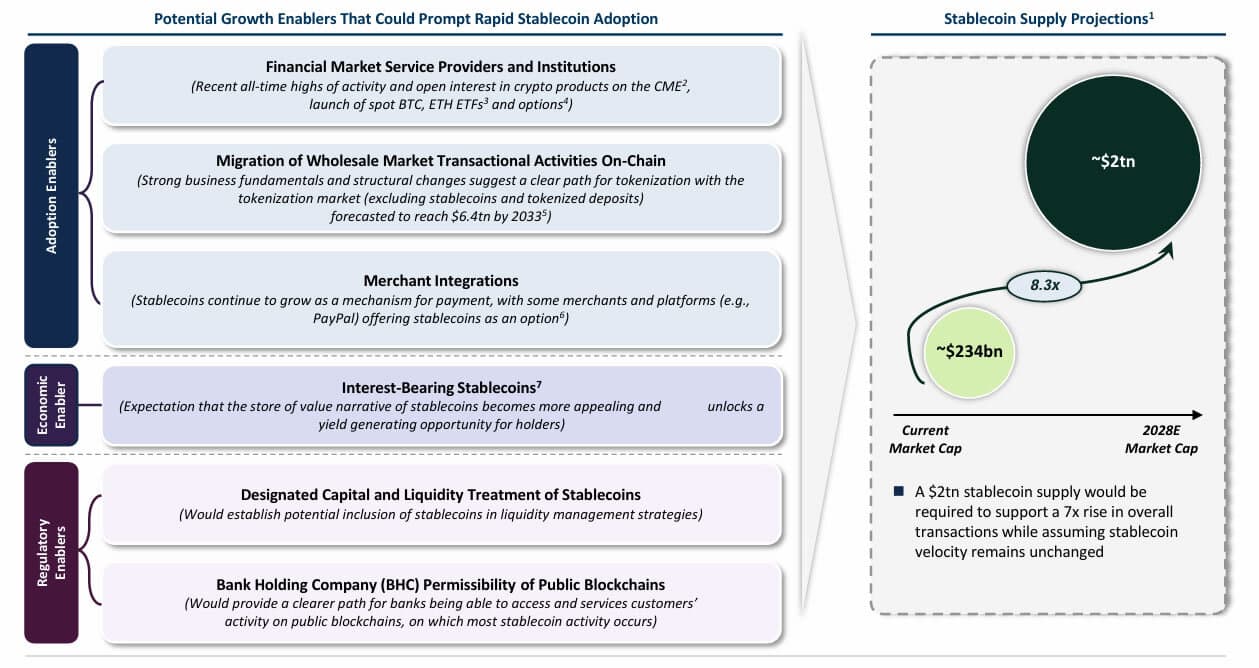

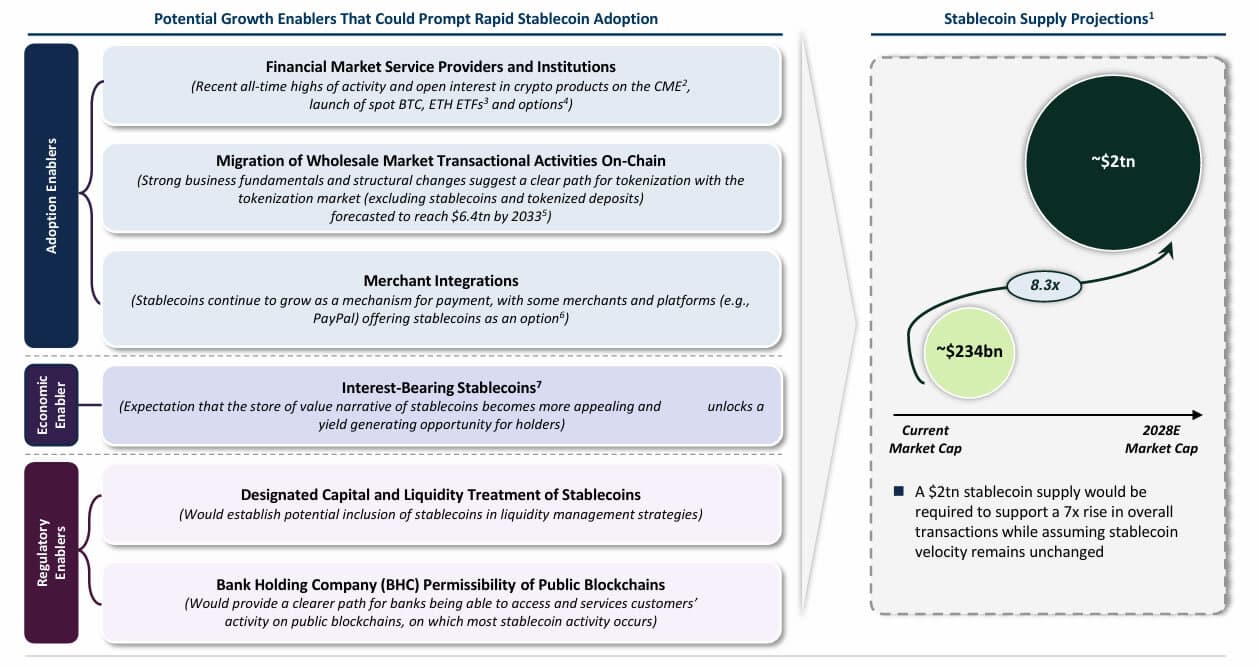

The research noted that there could be an 8.3x increase from the current stablecoin market cap of $234 billion in April 2025 to about $2 trillion by 2028.

“Evolving market dynamics have the potential to accelerate stablecoins’ trajectory to reach $2 trillion in market cap by 2028.”

Big Predictions for Future Growth

This projection assumes the passage of the GENIUS Act in the US, which would establish clear regulatory guidelines and drive market confidence and adoption.

The GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins) defines “payment stablecoins” as digital assets redeemable at a fixed value, pegged to fiat, but non-yield-bearing. It also sets out reserve rules for stablecoin issuers.

In early April 2, the US House Financial Services Committee passed the STABLE Act, which gives the Office of the Comptroller of the Currency (OCC) the authority to approve and supervise “federally qualified nonbank payment stablecoin issuers.”

Stablecoin reserve requirements could also drive large demand for short-dated U.S. Treasuries, it stated. Projections suggest stablecoin issuers could hold around $1 trillion in T-bills by 2028 if growth hits expectations.

The Treasury also predicted that stablecoin transactions could rise from around $700 billion per month today to around $6 trillion per month by 2028, which is roughly 10% of global forex spot transactions.

If regulatory clarity is achieved, stablecoins could become a mainstream financial instrument not just for crypto users, but for traditional finance, corporate treasury, and even sovereign liquidity management.

For users in emerging markets, stablecoins provide direct access to US dollars without needing a US bank account, strengthening the currency’s global role, the report noted.

Stablecoin Ecosystem Outlook

The current stablecoin market capitalization is $244.5 billion, which represents around 8% of the total crypto market cap, which is just over $3 trillion, according to Coingecko.

The lion’s share of the stablecoin market is currently dominated by Tether, which has a 61% share with $149 billion USDT in circulation.

Circle is second with $61 billion in USDC circulation, giving it a 25% market share, and decentralized USDS (formerly DAI) is third with 3% of the stablecoin market.

PayPal has seen significant growth for its PYUSD stablecoin this year. However, it has less than 0.36% market share. The company partnered with Coinbase recently to boost the adoption of its dollar-pegged stablecoin.

The post US Treasury Predicts Stablecoin Market Could Surge to $2 Trillion by 2028 appeared first on CryptoPotato.

Powered by WPeMatico