VanEck: Solana DEX Volumes Surpass Ethereum’s Despite Drop in Meme Coin Trading

According to VanEck’s February crypto report, Solana’s decentralized exchange (DEX) volumes have shown resilience despite declining meme coin trading.

The report shows that Solana’s trading activity briefly surpassed that of the Ethereum ecosystem, including its Layer 1 (L1) and Layer 2 (L2) networks.

Solana Maintains High Trading Activity

VanEck’s analysts revealed that the price of Solana (SOL) increased by 191% in 2024, while its on-chain revenues grew by 700%. The blockchain’s low transaction fees, averaging $0.05 compared to Ethereum’s $1.27, have contributed to its ability to handle high trade volumes efficiently.

Meme coin trading has added majorly to Solana’s revenue, accounting for approximately 80%. Pump.fun, the network’s meme coin maker, has also collected over $577 million in fees within a year.

However, the market has been affected by concerns about insider trading and automated bots purchasing tokens before retail investors, with the LIBRA coin controversy an example of this. Launched in February, the coin got mired in allegations of insider trading and market manipulation when its value quickly collapsed, leaving investors reeling from millions worth of losses.

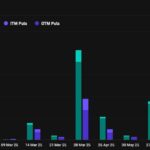

In that same month, a collapse in meme coin trading led to an 80% drop in Solana’s stablecoin transfers from its January levels. Other trading metrics also declined, with DEX volumes falling by 55%, fees collected dropping by 63%, and MEV activity decreasing by 63%.

Despite these setbacks, the network’s overall trading volumes remained competitive with Ethereum’s entire ecosystem. Further, the blockchain is set to undergo multiple protocol upgrades, which are expected to enhance its performance.

Ethereum’s Decline and Potential Solutions

Ethereum has also seen a decline in revenue and overall usage. Over the past year, gas prices have fallen 88%, and its revenue has dropped 93%. The network’s share of total blockchain revenue decreased from 55% in February 2024 to 24% in February 2025.

According to Matthew Siegel and Patrick Bush from VanEck, Ethereum’s strategy of encouraging users to move to L2 solutions has reduced activity on its Mainnet. As a result, major projects such as Uniswap and Ondo have begun expanding beyond the network.

Meanwhile, its transaction throughput remains lower than competing blockchains, with a recorded maximum of 63 transactions per second (TPS) compared to Solana’s 4,000 TPS.

To address these challenges, validators increased gas limits by 20% in February, raising transaction capacity from 30 million to 36 million gas units. The upcoming Pectra upgrade, set for this month, includes changes to L2 blob capacity, validator stake limits, and staking processes.

Additionally, the Ethereum Foundation has introduced Intents, a software update aimed at improving transaction efficiency across Layer 2 networks.

The post VanEck: Solana DEX Volumes Surpass Ethereum’s Despite Drop in Meme Coin Trading appeared first on CryptoPotato.

Powered by WPeMatico