Why Did Coinbase’s (COIN) Shares Dump 9.5% on Thursday?

Coinbase became arguably the most important crypto player in the US this year as numerous ETF providers, including BlackRock, chose the platform to serve as custodian to their Bitcoin exchange-traded funds.

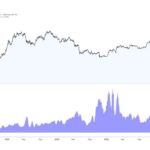

Adding the overall bull run for the entire market resulted in positive price movements for its shares, which jumped to over $250 earlier this year. However, COIN dumped hard on Thursday, perhaps due to rising competition on local soil.

The Brian Armstrong-spearheaded company has become something of a monopolist on the Bitcoin ETF custodian front mostly because it is among the few publicly-traded crypto exchanges in the States.

This benefited the company during the first quarter of 2024 – when the ETFs launched – and its Q1 report beat expectations, posting a massive revenue surge of 72%.

Naturally, this also impacted Coinbase’s shares, which jumped from about $156 at the start of the year to a multi-month peak of $280 in late March, taking advantage of the broader crypto market resurgence and BTC’s new ATH.

However, COIN started to retrace alongside the rest of the market in April and May but still maintained a healthy level of over $200. That changed yesterday when the shares dropped by 9.43% from $215 to $199.

The most probable reason for this is not related to the market moves, as BTC was well in the green, skyrocketing to a 3-week high of over $66,500. In fact, it could be related to impending competition on the spot trading front in the US.

CME Group, typically known for its involvement in futures Bitcoin and Ethereum trading, outlined initial plans to introduce spot BTC trading services. Given the fact that CME is a well-established player in traditional finance and has a rich history in crypto, such a potential launch could take away market share for dominant forces like Coinbase and Binance.

Separately, Cathie Wood’s Ark Invest has been gradually offloading its COIN shares for the past few weeks, which could also increase the selling pressure.

The post Why Did Coinbase’s (COIN) Shares Dump 9.5% on Thursday? appeared first on CryptoPotato.

Powered by WPeMatico