A new report from Bitget has revealed that crypto adoption trends are shifting from speculation to spending. Based on an online survey of 4,599 participants from the Bitget Wallet community, the data showed that over 35% use it for daily transactions, gaming, and travel. A Global Shift The study shared with CryptoPotato had respondents outlining […]

Blockchain network reached a new milestone by hitting a weekly record of over 340 million transactions, the highest ever registered in a seven-day period. This historic high is likely signaling growing user engagement and renewed optimism for the cryptocurrency sector. Deeper Dive Into The Stats According to data from analytics company Dune, the lion’s share […]

TL;DR Thumzup shifts from Bitcoin-only to a $250M diversified crypto portfolio with altcoins and stablecoins. Trump Jr.’s $4M investment and new U.S. crypto laws add momentum to Thumzup’s expansion strategy. XRP hits $3.65 as Thumzup shares rise 267% since January, fueling investor interest in digital assets. Thumzup Expands Crypto Holdings Beyond Bitcoin Thumzup Media Corporation, […]

Ethereum has reclaimed a crucial resistance region at the $3.5K mark, showcasing notable buying activity. Nevertheless, the price has now reached a critical order block around the $3.7K range, suggesting a potential period of consolidation before any further upside continuation. Technical Analysis By Shayan ETH Price Analysis: The Daily Chart ETH has continued its bullish […]

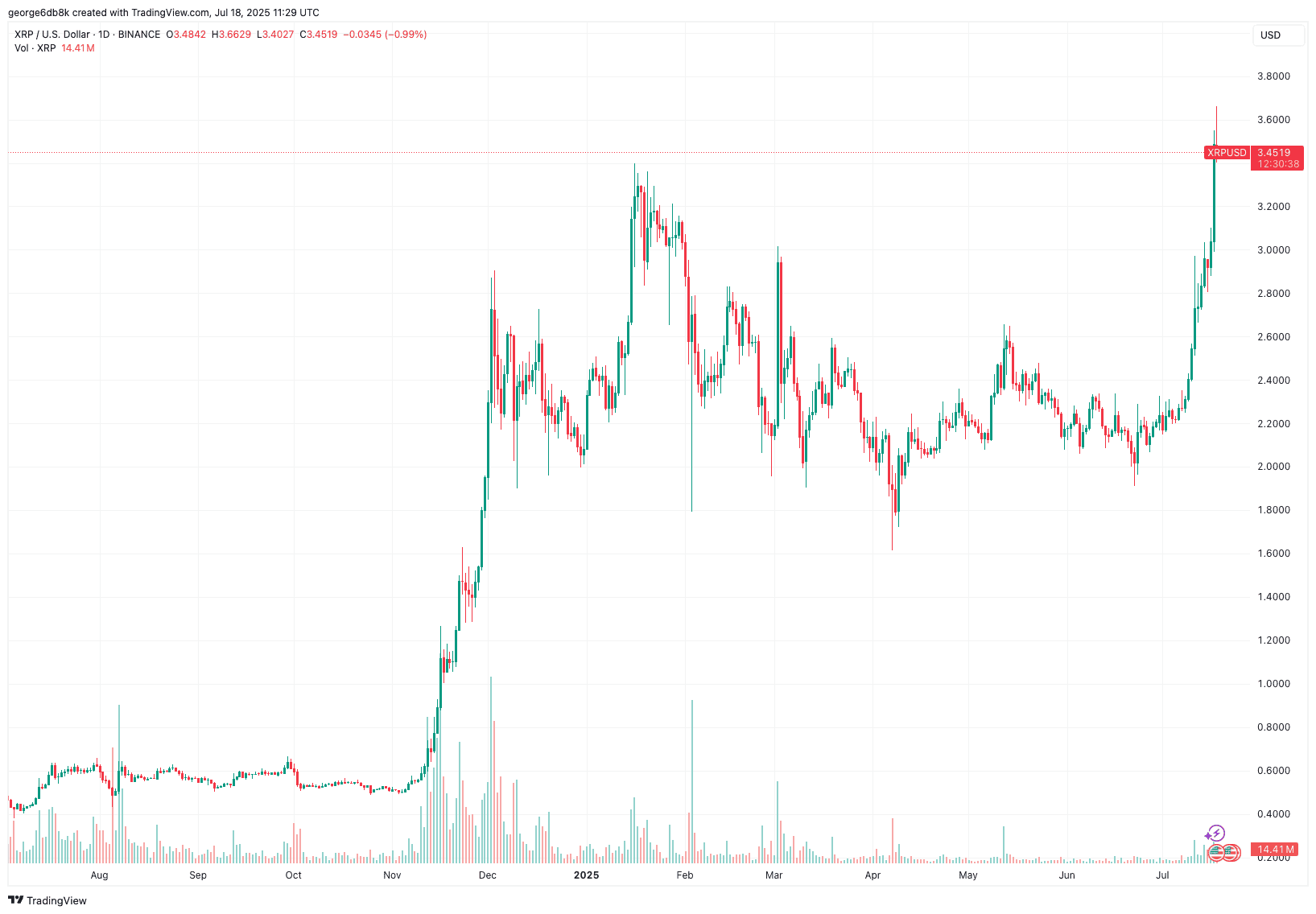

XRP has been trading all high and mighty over the past week, adding more than 32.5% to its price in the interim. It achieved a brand new all-time high and it appears that it’s riding on the momentum of becoming the 3rd-largest cryptocurrency by means of total market cap, at least at the time of […]

Ondo Finance, a designer of institutional-grade platforms, assets, and infrastructure, has introduced a novel approach to moving traditional assets onto the blockchain. Built on Sei’s infrastructure for digital asset exchanges, this marks a further collaboration between industry peers, bridging the gap between Web2 and Web3. An Industry First The decentralized finance (DeFi) platform Ondo announced yesterday […]

On Monday, Cramer posted an idea for a new acronym that encapsulates two crypto stocks and one with strong ties to the blockchain industry and cryptocurrency markets. New meme acronym: PARC– Palantir, Applovin, Robinhood and Coinbase (PARC)v Coinbase, Applovin, Robinhood, Palantir (CARP) which should it be?? @SquawkStreet . — Jim Cramer (@jimcramer) July 14, 2025 […]

The Trump family’s flagship crypto business, World Liberty Financial (WLF), has ramped up its Ethereum (ETH) accumulation, spending $3 million in USDC on July 18 to acquire an additional 861 ETH. According to Lookonchain, this latest buy brings WLF’s total ETH holdings to 70,143, worth an estimated $251 million, with over $23 million in unrealized […]

XRP prices have pumped almost 20% over the past 24 hours, propelling the asset to an all-time high of $3.64, according to CoinGecko. The massive move has also pushed the cryptocurrency’s market capitalization to $214 billion, which is about the same size as fast food giant McDonald’s, cementing its place as the third-largest cryptocurrency. XRP […]

Around 41,500 Bitcoin options contracts will expire on Friday, July 18, and they have a notional value of roughly $5 billion. This event is larger than last week’s expiry but unlikely to be enough to influence spot markets, which have been performing solidly this week. ‘Crypto Week’ in the United States has been chaotic, but the […]