How Will Crypto Markets React to $1.1B Bitcoin Options Expiring Today?

Around 18,400 Bitcoin options contracts are due for expiry on Friday, August 23. They have a notional value of around $1.1 billion.

Today’s options expiry event is a little smaller than last week’s, so its impact on spot markets is likely to be limited. The much larger month-end expiry event next week has a notional value of $3.5 billion.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.83, which means that longs and shorts are more closely aligned with slightly more long (call) contracts expiring than shorts (puts). The max pain, or point at which most losses will be made, is at $60,000, which is very close to current spot prices.

Open interest, or the number of value of contracts yet to expire, is still high at strike prices above $70,000, according to Deribit. Additionally, there is around $967 million in OI at the $100,000 strike price, with bulls hanging in for a big rise in BTC prices.

On Aug. 22, crypto derivatives provider Greeks Live commented that this week’s macro events and data “did not bring too many waves.” It added that the historical volatility (RV) of cryptocurrencies continued to go down, “and the options market’s expectations for volatility are gradually decreasing.”

“Options data suggests that the market is in a highly calm cycle, with a solid term structure and a gradually decreasing expectation of future volatility in the options market.”

Aug. 23 Options Data

18,000 BTC options are about to expire with a Put Call Ratio of 0.83, a Maxpain point of $60,000 and a notional value of $1.12 billion.

140,000 ETH options are about to expire with a Put Call Ratio of 0.93, Maxpain point of $26,25 and a notional value of $370… pic.twitter.com/qIS2CWer13— Greeks.live (@GreeksLive) August 23, 2024

In addition to today’s expiring Bitcoin options, there are 140,000 Ethereum options about to expire. These have a notional value of $370 million, a put/call ratio of 0.93, and a max pain point of $2,625.

Crypto Market Outlook

With a low options expiry event and markets remaining relatively flat, it is unlikely that there will be a large impact unless there are big surprises at today’s Fed speech at Jackson Hole.

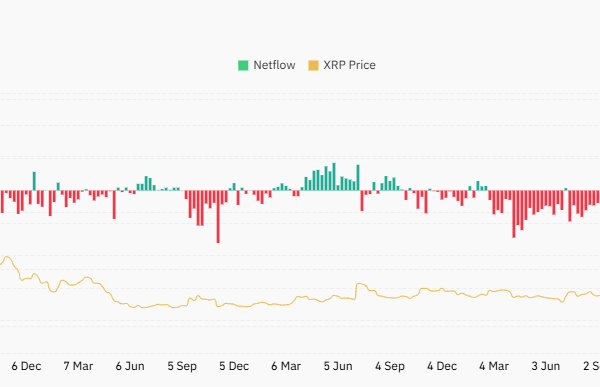

Total crypto capitalization has remained flat on the day at $2.24 trillion, having gradually downtrended since mid-March. Bitcoin has remained over $60,000 for the past 24 hours and was trading at $60,654 at the time of writing.

Ethereum was up 1.2% on the day, changing hands for $2,634 during the Friday morning Asian trading session.

The altcoins were generally in the green, with Binance Coin (BNB), Avalanche (AVAX), and Near Protocol (NEAR) outperforming the market at the moment.

The post How Will Crypto Markets React to $1.1B Bitcoin Options Expiring Today? appeared first on CryptoPotato.

Powered by WPeMatico