Will Today’s $4.3B Crypto Options Expiry Impact Spot Markets?

Around 30,000 Bitcoin options contracts will expire on Friday, September 19, and they have a notional value of roughly $3.5 billion.

This expiry event is pretty close to last week’s, so there is unlikely to be any impact on spot markets, which have moved higher this week.

The US Federal Reserve’s first rate reduction of the year was largely priced in by markets, which have taken a minor dip this Friday morning.

Bitcoin Options Expiry

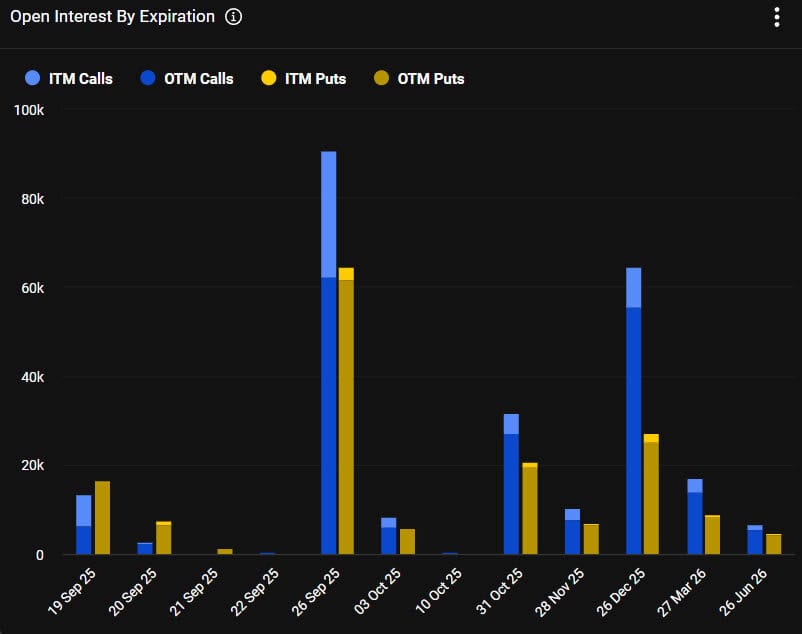

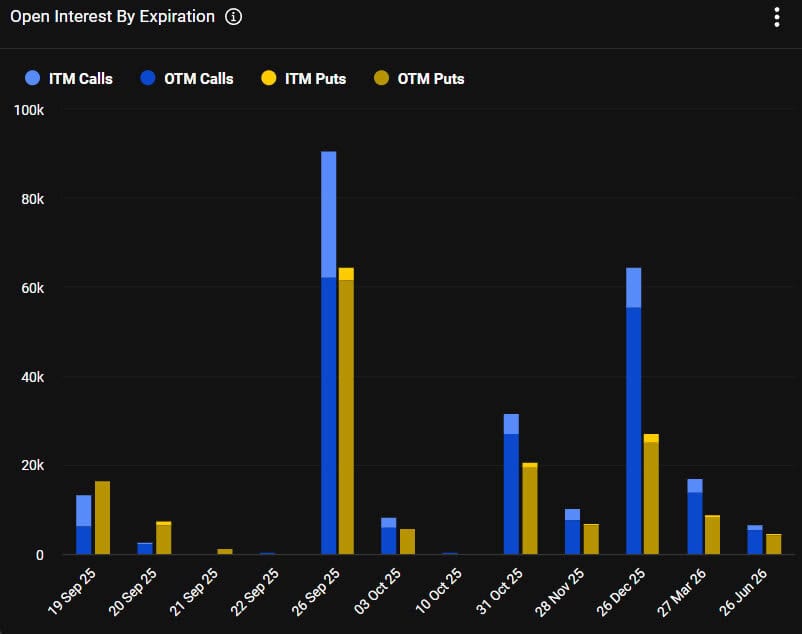

This week’s batch of Bitcoin options contracts has a put/call ratio of 1.2, meaning that there are more short contracts expiring than longs, as bearish speculation increases.

Open interest (OI), or the value or number of BTC options contracts yet to expire, is highest at $140,000, which has reached $2.7 billion at this strike price on Deribit. There is also around $2.2 billion OI at $120,000, but $95,000 is a popular strike price for short sellers with $2 billion in OI.

Additionally, total Bitcoin futures OI currently stands at $86 billion, which has climbed back toward all-time highs, according to CoinGlass.

“Recent actual volatility has also been substantial, showing a marked increase compared to last month, yet actual trading volume has declined instead; volatility levels and trading volume have diverged,” said crypto derivatives provider Greeks Live earlier this week.

In addition to today’s batch of Bitcoin options, there are around 177,500 Ethereum contracts that are also expiring, with a notional value of $815 million, and a put/call ratio of 1. This brings Friday’s combined crypto options expiry notional value to around $4.3 billion.

Crypto Market Outlook

Total crypto market capitalization has retreated slightly over the past few hours, but remains near peak levels at $4.2 trillion. Zooming out shows that overall digital asset markets have been trading sideways since mid-July.

Bitcoin inched toward $118,000 in late trading on Thursday, took a wild swing down to $116,750 before recovering to reclaim $117,000 in Friday morning trading in Asia. The asset is around 5.6% away from its all-time high and is maintaining its gains with no major September slump yet.

Ethereum has held steady around the $4,600 level for the past 24 hours and remains 7% away from its all-time high.

The altcoins have had a solid week with Hyperlink (HYPE) and Binance Coin (BNB) hitting all-time highs. Chainlink, Avalanche, and Sui are today’s top performers while the rest of the high-cap alts remain flat.

The post Will Today’s $4.3B Crypto Options Expiry Impact Spot Markets? appeared first on CryptoPotato.

Powered by WPeMatico