Ethereum ETF Inflows Cool Off as Bitcoin Continues Consolidation: Bitfinex Alpha

Following a phase of consistent flows into spot Ethereum exchange-traded funds (ETFs), investors are taking a break. This cool-off period comes as ether (ETH) hovers about 15% from its recent all-time high (ATH), and BTC remains range-bound between $108,000 and $113,000.

Analysts at the cryptocurrency exchange Bitfinex revealed that Ethereum ETFs have just recorded their second-largest single-day outflow since their launch.

Ethereum ETF Inflows Cool Off

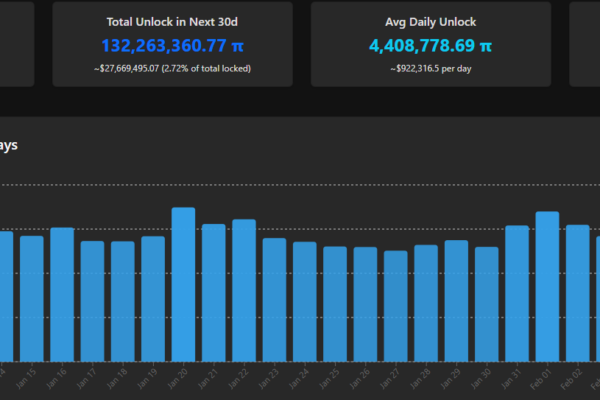

According to this week’s Bitfinex Alpha report, the 14-day average of net flows into Bitcoin and Ethereum ETFs highlights the significant role these products have played in recent price action. Between May and August, daily allocations of 55,000 to 85,000 ETH to Ethereum ETFs drove the cryptocurrency to new highs. However, the slowing demand over the last two weeks has contributed to a slowdown in momentum.

Flows into these Ethereum products fell to 16,600 daily in the last week of August. They declined even further to an average of -41,400 ETH last week. On Friday, 104,100 ETH, worth approximately $447 million, left Ethereum ETFs, marking the second-highest outflow day since inception.

Bitfinex noted that the price action of both BTC and ETH has become increasingly dependent on ETFs and treasury companies. Although ETH shows a relatively higher dependency, the ETFs for both assets currently reflect a pullback in traditional finance (TradFi) buying power.

“This slowdown highlights the sensitivity of institutional demand to both price and macroeconomic conditions, and reinforces the role of ETF flows as a decisive determinant of whether digital assets can regain upward momentum or remain range-bound in the near term,” the report stated.

BTC to Mark Cyclical Low This Month

Furthermore, the structure of TradFi demand between Bitcoin and Ethereum ETFs has deviated significantly. This is seen by comparing cumulative ETF flows with bi-weekly changes in futures open interest for both assets.

Data accessed by analysts show that investors have primarily expressed demand for BTC through direct spot exposure rather than futures positioning. ETH, on the other hand, combines spot allocations with “cash-and-carry strategies.”

“The result is a distinct profile of institutional engagement while BTC flows reflect clearer directional conviction, ETH flows highlight a balance between speculative demand and structured arbitrage-driven participation,” analysts added.

Meanwhile, Bitfinex insists that while BTC still faces the risk of deeper correction in the near term, the asset could mark a cyclical low in September ahead of a rally next quarter.

The post Ethereum ETF Inflows Cool Off as Bitcoin Continues Consolidation: Bitfinex Alpha appeared first on CryptoPotato.

Powered by WPeMatico