No Demand? BlackRock’s ETH Fund Enters Top 6 ETF Launches of 2024

BlackRock has been proving the pundits wrong amid claims that there has been little or no demand for spot Ethereum’s ETFs,

The asset manager’s ETHA ETF took another $108.4 million in daily inflows on Aug. 6. This comes in the same week that the underlying asset devalued by around 25%.

On “crypto black Monday,” the fund took $47 million, bringing its total inflows to around $868 million in just two weeks.

“That $160 million alone would put it in the top 10% of all new ETFs this year,” exclaimed ETF Store President Nate Geraci in a post on X on Aug. 7.

No Demand? Yeah Right!

In the post he titled “No Demand,” Geraci added that this puts the BlackRock ETHA fund among the top six ETF launches this year in terms of inflows.

After “Crypto Black Monday” (lol) where ETHA took in nearly $50mil…

It vacuums-up approx $110mil today.

That $160mil alone would put it in top 10% of all new ETFs this yr.

ETHA now nearing $900mil inflows 2 weeks in.

Top 6 ETF launch in 2024 (4 of 5 others = spot btc ETFs). https://t.co/JtEIXcu7Yc

— Nate Geraci (@NateGeraci) August 7, 2024

The big BlackRock inflow brings the total to $98.4 million in another positive day for ETH ETFs as institutional investors buy the dip.

Bloomberg senior ETF analyst Eric Balchunas simply exclaimed, “Maniacs.”

Maniacs https://t.co/yNuoc1YXFh

— Eric Balchunas (@EricBalchunas) August 6, 2024

Fidelity’s FETH fund had $22.5 million, and the only outflows were from Grayscale’s ETHE, which lost $39.7 million.

Meanwhile, demand for spot ETH remains a little flat with prices hovering around $2,500 for the past day following the asset’s epic fall earlier this week.

In late July, just after spot ETH ETFs were launched, USD News reported that six of the top ten best-performing ETFs so far in 2024 were crypto-related.

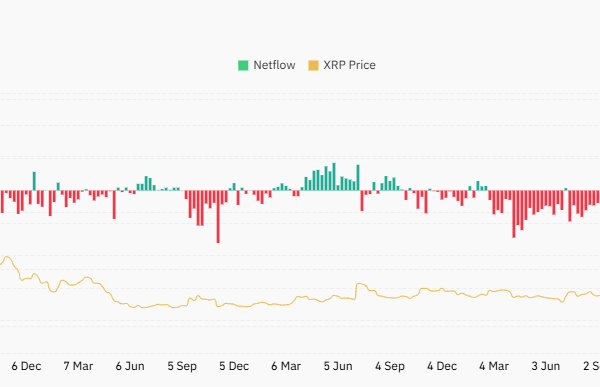

However, spot Bitcoin ETFs saw another day of outflows, with $148.6 million leaving the products on aggregate on Aug. 6, according to preliminary data from Farside Investors.

Spot ETH ETF Options

On Aug. 6, BlackRock and Nasdaq proposed a rule change to list and trade options for BlackRock’s spot Ethereum ETF.

Crypto options differ a little from spot funds as they give investors the right to buy or sell the ETF at a predetermined price by a set date. The filing stated:

“The exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot Ether,”

Nasdaq and BlackRock’s filing to add options on Ethereum ETFs has hit the SEC site. Final SEC decision on this from SEC likely to be around April 9th, 2025.

(SEC is not the only decision maker on adding options here. Also need signoff from OCC & CFTC) https://t.co/K4HunUPp7S pic.twitter.com/5kQH0mljTz

— James Seyffart (@JSeyff) August 6, 2024

The SEC gave the nod to Ethereum ETFs from giants like BlackRock, Fidelity, and Franklin Templeton, “showing ETH’s mainstream takeover,” commented Mario Nawfal on the latest news.

The post No Demand? BlackRock’s ETH Fund Enters Top 6 ETF Launches of 2024 appeared first on CryptoPotato.

Powered by WPeMatico