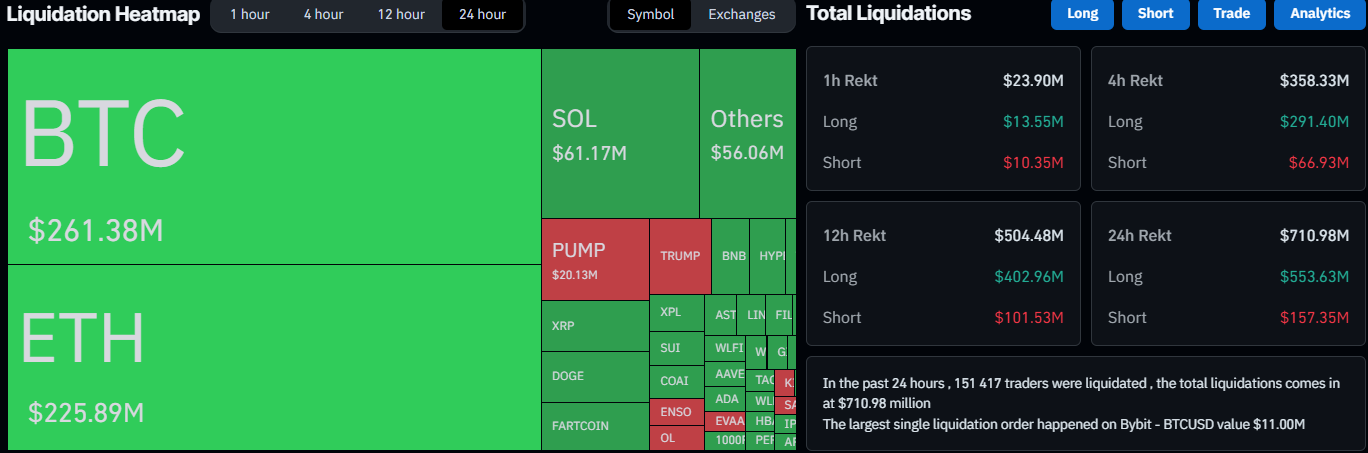

Bitcoin ended the calendar week with a price resurgance that only intensified as the new one began, and the asset jumped to almost $107,000 for the first time since last Tuesday. Naturally, this explosive month north has harmed certain over-leveraged traders. The popular account going under the name James Wynn made the headlines again by […]

Digital Asset Treasury Companies (DATCos) have deployed at least $42.7 billion in crypto acquisitions so far in 2025. Interestingly, more than half of that amount was spent in the third quarter alone, when DATCos collectively acquired $22.6 billion worth of digital assets. Q3 2025 has therefore been the strongest quarter on record for DATCo accumulation. […]

The crypto market has been in a weak state over the last few weeks, with bitcoin (BTC) finally falling below $100,000 on Tuesday. Amid speculations about the end of the bull cycle, trader and market expert Arthur Hayes has identified an event that could reignite the bull run. According to Hayes, everything is tied to […]

Columbia Business School professor Omid Malekan said that any analysis of why crypto prices continue to fall needs to include Digital Asset Treasuries (DATs), because in aggregate, they turned out to be a mass extraction and exit event, which is a reason for prices to go down. He said there are a few exceptions, but […]

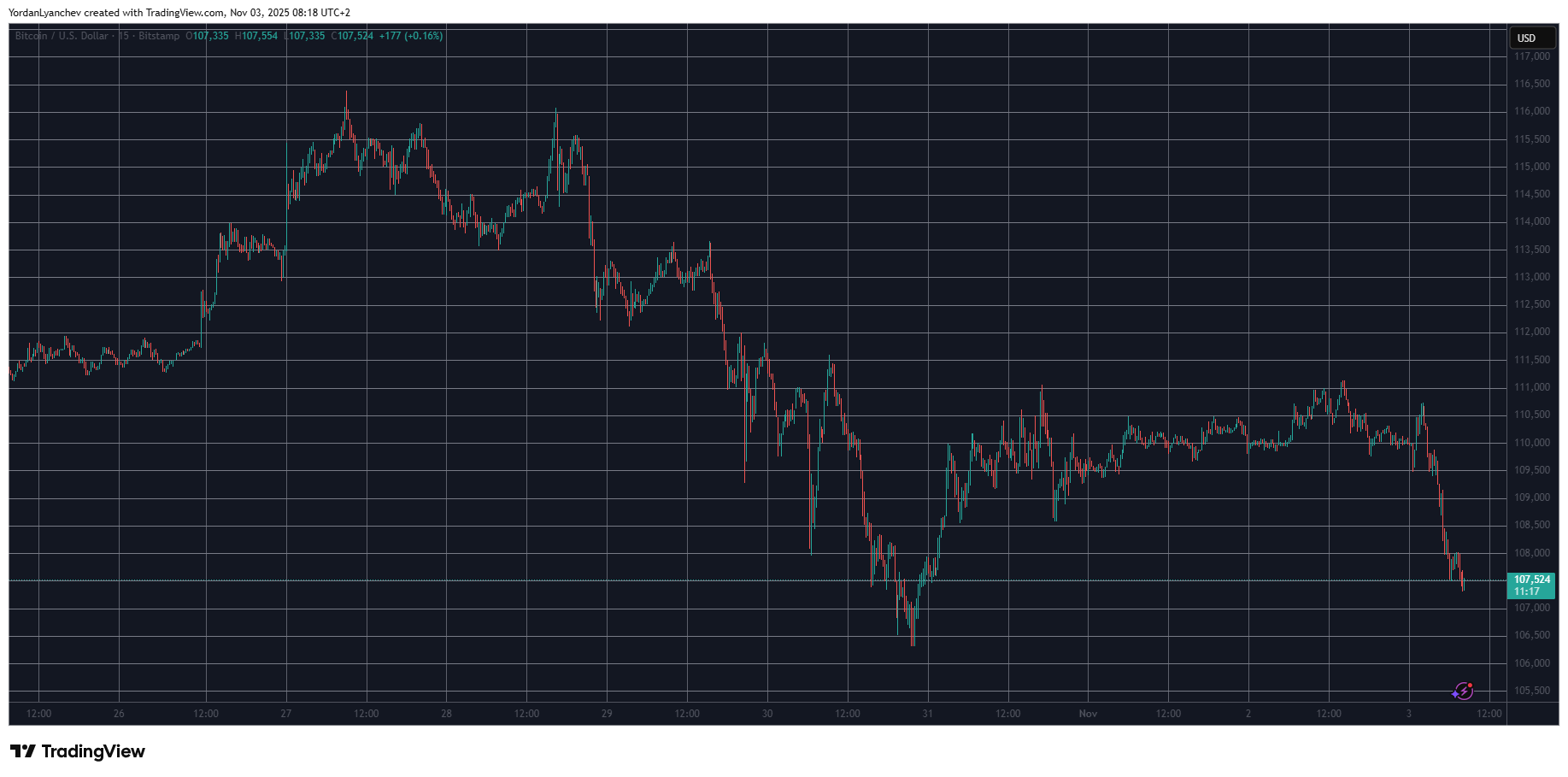

The broader economic perspective shows few signs to worry and it certainly couldn’t predict what transpired in the cryptocurrency markets at the start of the current business week. Bitcoin traded at $111,000 on Sunday evening, ETH was above $3,900, XRP was at $2.60, and so on. What followed, though, was a market-wide crash that pushed […]

The world’s largest crypto by market capitalization has failed to stay within its consolidation range between $106,000 $116,000 as buying power wanes, according to Bitfinex Alpha. The price movement is demonstrating little conviction from the bulls, leading to a decline in investor confidence and sentiment. The crypto asset briefly climbed to $116,000 last week, offering […]

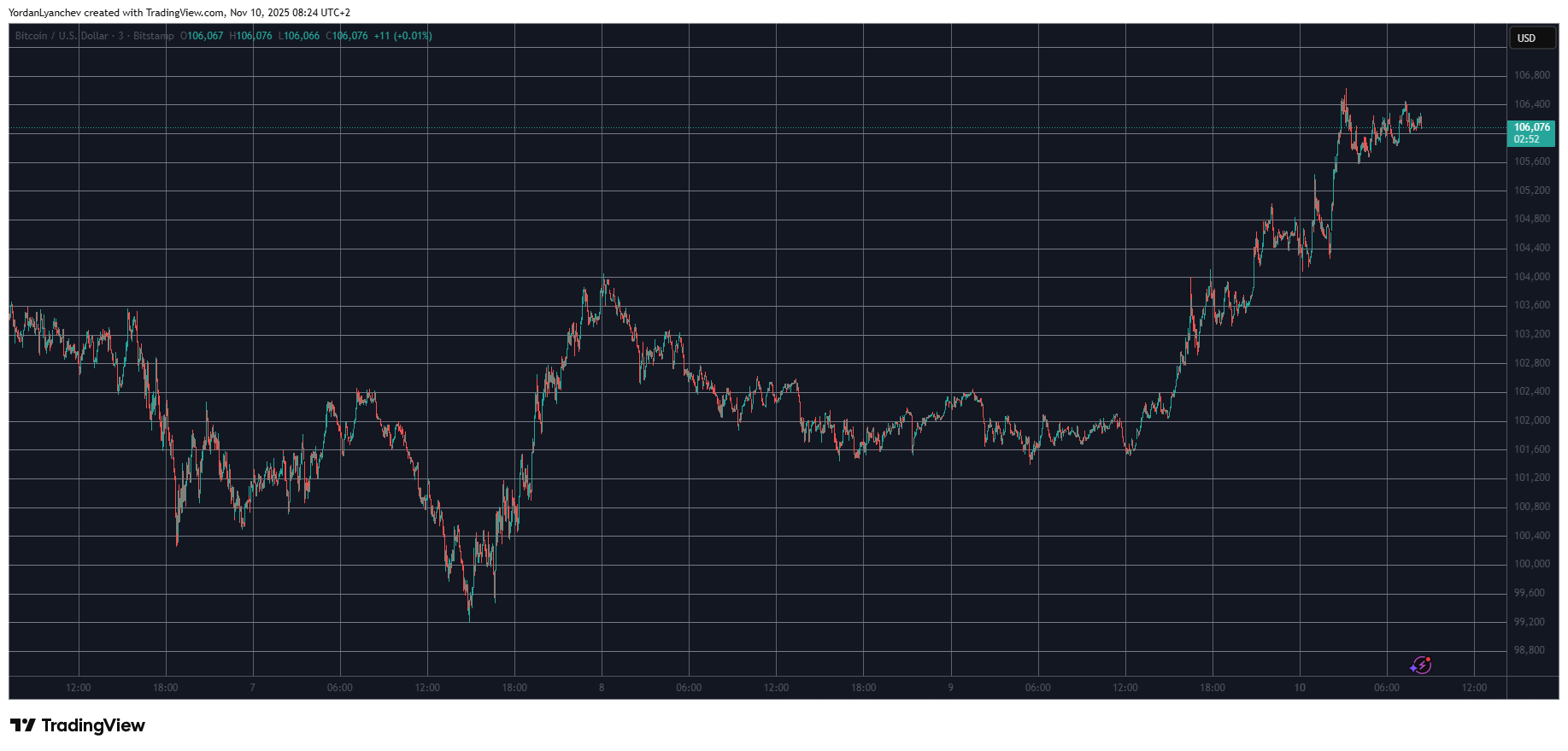

Bitcoin’s minor rally on Sunday ended with another rejection that pushed the asset south hard to just over $107,000 minutes ago. Aside from the POTUS’s most recent comments on several highly volatile topics, BTC OG wallets have deposited large amounts to centralized exchanges with the most likely plan to sell them. BTCUSD. Source: TradingView Trump’s […]

The U.S.–China trade alignment and the Federal Reserve’s recent rate cut have eased macroeconomic pressures, creating favorable conditions for risk assets. Yet, Bitcoin’s next move will depend on whether it can confirm a breakout above the 100-day MA or hold the 200-day MA as structural support. Until one side of this equilibrium breaks, the market […]

The presidents of the two most powerful economies in the world met in South Korea earlier today, which resulted in several tariff reductions on China. US President Donald Trump outlined the decisions made after the meeting, including an overall tariff cut from 57% to 47%. Some products, such as fentanyl, were dropped to 10%. BREAKING: […]

The US Federal Reserve did what many anticipated and lowered the key interest rates by 25 bps earlier today. Although such a move is typically regarded as bullish for risk-on assets like crypto, the reality is that the immediate effect has been anything but positive. Even before the FOMC meeting, though, many expected such behavior […]